-

Posted in News, News for Cyprus

Cyprus Tax News: Directive for the beneficial ownership register of express trusts

On the 18th June 2021, the Cyprus Securities and Exchange Commission (“CySec”), being the competent independent authority for maintaining and operating the Trusts UBO Registry as required…

-

Posted in EMPLOYMENT PRACTICE, News, News for Greece

Ηarassment and violence at work: New institutional framework of Law 4808/2021

Recently we had extensively referred to a relevant podcast on the issue of sexual harassment in the workplace, to which we return on the occasion of the publication of the new Law 4808/2021 (Government Gazette 101 / A ‘/ 19.06.2021),…

-

Posted in News, News for Cyprus

Cyprus Tax News: Cyprus – Netherlands tax treaty signed and published

On 1 June 2021, Cyprus signed a tax treaty for the avoidance of double taxation (the “treaty”) with the Netherlands, which was published in the Official Gazette on 4 June 2021, the date of ratification by Cyprus.

-

Posted in News, News for Cyprus, News for Greece

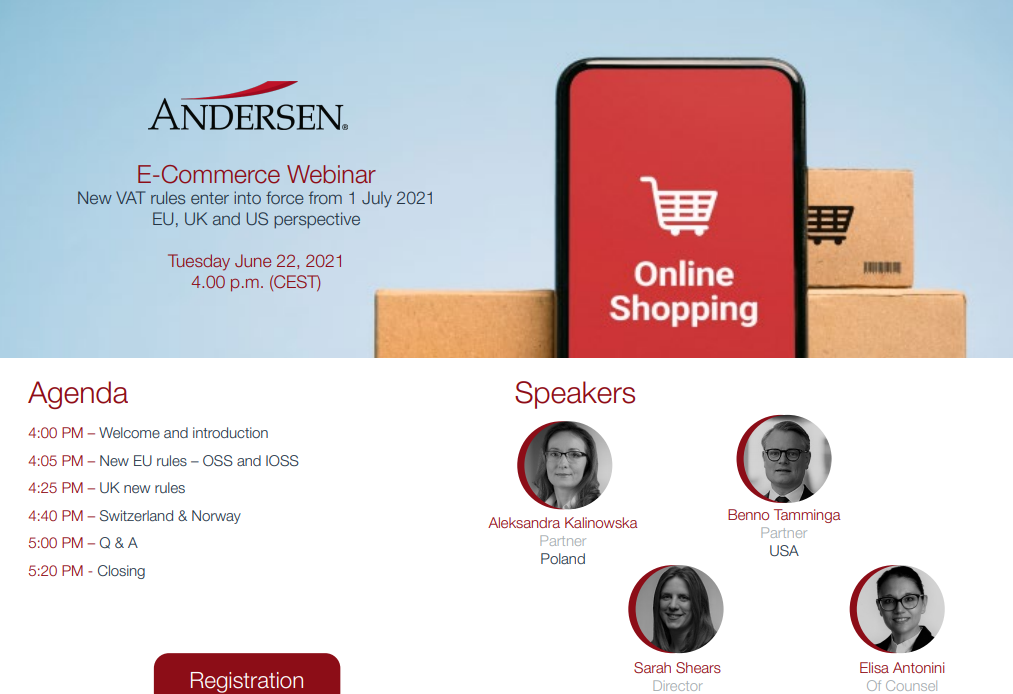

E-Commerce Webinar: 22 JUNE, 4 PM CET

VAT & Customs Service Line of Andersen will organize a webinar on 22nd of June. Read the webinar agenda and the key speakers and click to register.

-

GDPR Flash news: Greek DPA imposes fine for non-compliance with data subject’s rights

The article refers to the recent fine imposed by the Greek DPA on well-established job-seeking platform for non-compliance with a data subject’s right to erasure. The audit performed revealed…

-

Posted in BANKING FINANCE & CAPITAL MARKETS, News, News for Greece

Banking, Finance & Capital Markets: Corporate Governance

The Hellenic Capital Market Commission (HCMC) issues guidelines and recommendations to Listed Companies towards compliance with the new Law 4706/2020 on Corporate Governance.

-

Posted in News, News for Cyprus

Cyprus Tax News: Tax treatment of effects of adopting IFRS 9, 15, and 16 clarified

On 17 May 2021, the Tax Department issued a Guideline providing clarifications with respect to the tax treatment of the impact on the financial statements from the application of IFRS 9, IFRS 15 and IFRS 16 for both Income Tax (IT) purposes…

-

Episode #7 Related Parties Transactions: An Overview

On Episode7 of the Andersen Legal Podcast, Dimitra Gkanatsiou, Head of Corporate & Commercial and Andriani Tzamarou, Associate are providing an overview of the “Related Parties Transactions”.

-

Posted in BANKING FINANCE & CAPITAL MARKETS, News, News for Greece

Banking, Finance & Capital Markets: An Introduction

The Banking, Finance and Capital Markets practice is under a process of a radical reform and our promise is to actively support our clients’ sustainable growth on the field

-

Posted in EMPLOYMENT PRACTICE, News, News for Cyprus, News for Greece

EMPLOYMENT WEBINAR | Covid-related restrictions for employment termination across Europe

The European Employment group hosted a Webinar to cover the Covid-related restrictions for employment terminations. Below you may find a summary of the event insights.